Muat turun aplikasi

-

- Platform Dagangan

- Aplikasi PU Prime

- PU Copy Trading

- PU Sosial

-

- Syarat Perdagangan

- Jenis Akaun

- Spread, Kos & Swap

- Deposit & Pengeluaran

- Yuran & Caj

- Waktu Dagangan

Muat turun aplikasi

Market Summary

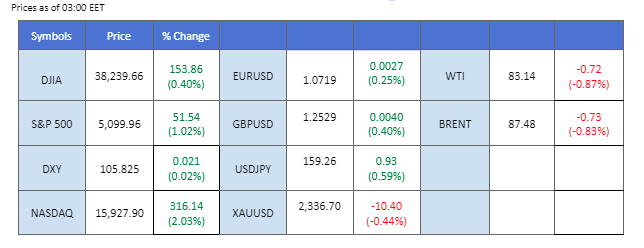

The U.S. Personal Consumption Expenditures (PCE) data released last Friday slightly surpassed market expectations and the previous reading, supported by recent positive economic indicators in the U.S. This bolstered the dollar index, as investors interpreted the data as a sign that the Federal Reserve may scale back its plans for interest rate reductions this year. However, attention shifted to the equity markets, where the S&P 500 saw a nearly 3% gain last week. This was attributed to optimism surrounding companies’ earnings reports during the ongoing earnings season.

Meanwhile, in Japan, the Japanese Yen breached the psychological resistance level at 160 against the U.S. dollar, as market participants observed no signs of intervention from Japanese authorities to support the currency. In the commodity markets, gold prices were impacted by the upbeat PCE reading, which strengthened the dollar and exerted downward pressure on gold. Additionally, oil prices eased as optimism grew regarding developments in the Middle East, particularly efforts by the U.S. to broker a peace deal between Israel and Hamas.

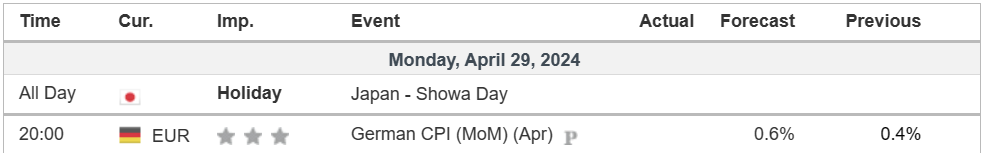

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The US Dollar mounted a sharp rebound following the release of better-than-expected inflation data, injecting fresh uncertainty into the outlook for the US economy. Despite previous indicators suggesting lacklustre economic performance, the unexpected surge in the US Core PCE Report underscored concerns about persistent inflationary pressures, potentially delaying any imminent interest rate cuts. Investors are now closely monitoring subsequent economic data releases and forthcoming Federal Reserve announcements to gauge the trajectory of monetary policy.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 106.35, 107.05

Support level: 105.70, 105.25

Gold prices retreated in the wake of the upbeat inflation report, as renewed demand for the US Dollar exerted downward pressure on the dollar-denominated precious metal. However, the outlook for gold remains contingent on further insights from key US economic indicators, including the eagerly anticipated Nonfarm Payrolls report and the Fed’s monetary policy decisions. Market participants are poised to react swiftly to any shifts in economic sentiment and policy direction.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 47, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2360.00, 2405.0

Support level: 2330.00, 2300.00

The GBP/USD pair held steady at recent highs, despite last Friday’s U.S. Personal Consumption Expenditures (PCE) data surpassing market expectations. The strength in the dollar, anticipated by the markets, was already factored into prices, and demand for the safe-haven currency diminished amidst signs of easing tensions in the Middle East.

The GBP/USD is still trading at its elevated levels and is currently resisted at the 1.2542 level. The RSI remains closely in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum is strong.

Resistance level: 1.2540, 1.2660

Support level: 1.2440, 1.2370

The EUR/USD pair experienced fluctuations in the previous session, primarily influenced by the strength of the dollar. The upbeat U.S. Personal Consumption Expenditures (PCE) reading initially bolstered the dollar’s strength but subsequently eased as sentiment shifted. The euro’s performance is anticipated to be influenced by Tuesday’s Consumer Price Index (CPI) readings, which will provide insights into inflation conditions in the region and their implications for the euro.

The pair remained trading with its bullish trajectory and was supported at near 1.6860 level The MACD remained hovering at above the zero line while the RSI flowing at above the 50 level suggested the bullish momentum remained strong.

Resistance level: 1.0775, 1.0866

Support level: 1.0630, 1.0560

The US equity market staged a notable rebound, buoyed by robust earnings performances from tech giants Alphabet Inc and Microsoft Corporation. The stellar first-quarter results triggered a surge in technology stocks, with investors optimistic about the sector’s prospects amid growing demand for artificial intelligence. Alphabet’s announcement of its inaugural dividend further bolstered confidence, propelling the stock to record highs, and underlining its resilience in the face of market volatility.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 17850.00, 18430.00

Support level: 16975.00, 16230.00

The USD/JPY pair surged to its highest level against the Japanese yen since 1990, surpassing the key psychological level of 160. The yen faced significant selling pressure in global markets, with investors shorting the currency amid a lack of intervention by Japanese authorities. However, this upward momentum was short-lived as sentiment swiftly changed.

The pair seesawed at its highest levels and expected to trade in a jumpy road ahead. The RSI declined sharply from the overbought zone while the MACD remained at the elevated level suggesting the bullish momentum is easing.

Resistance level: 156.90, 158.35

Support level:154.25, 153.30

Crude oil prices experienced a modest retreat amid a strengthening US Dollar, which tempered demand for the dollar-denominated commodity. Despite a backdrop of rising inflation and tightening supply dynamics, the dollar’s rally on expectations of prolonged interest rate hikes weighed on oil prices. However, market sentiment could swiftly shift if upcoming US inventory data and China’s PMI index reveal signs of improvement, potentially reversing the recent dip in oil prices.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 83.40, 84.95

Support level: 81.90, 80.45

Berdagang forex, indeks, Logam banyak lagi pada spread rendah industri dan pelaksanaan sepantas kilat.

Daftar untuk Akaun PU Prime Live dengan proses kami yang mudah

Membiayai akaun anda dengan pelbagai saluran dan mata wang yang diterima dengan mudah

Akses beratus-ratus instrumen di bawah keadaan perdagangan terkemuka pasaran

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!