Muat turun aplikasi

-

- Platform Dagangan

- Aplikasi PU Prime

- PU Copy Trading

- PU Sosial

-

- Syarat Perdagangan

- Jenis Akaun

- Spread, Kos & Swap

- Deposit & Pengeluaran

- Yuran & Caj

- Waktu Dagangan

Muat turun aplikasi

Market Summary

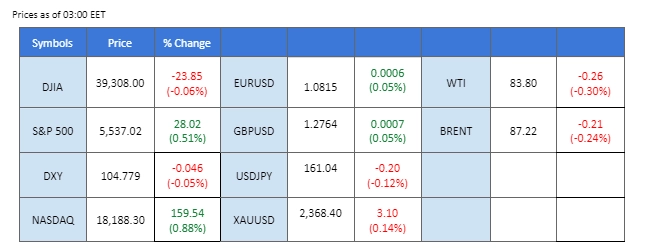

The UK general election 2024 was held on Thursday, and while the results are yet to be finalized, the Labour Party is poised to win a majority, ending the Conservatives’ 14-year rule. The UK’s equity market index, FTSE 100, edged higher in the last session, while the Pound Sterling remained steady. The Labour Party is expected to focus more on fiscal policy and economic development through expanding the country’s sovereign debt, which may strengthen the Pound Sterling.

The market is also closely watching today’s NFP report. A soft NFP would likely exert further downside pressure on the dollar, heightening speculation of a Fed rate cut. With Wall Street on pause due to the U.S. public holiday, global equities continued to edge higher, reflecting improved risk appetite. In the commodity market, gold prices are at their highest level in two weeks, while oil prices are buoyed by Hurricane Beryl, which is affecting production in the Gulf of Mexico and constraining oil supplies.

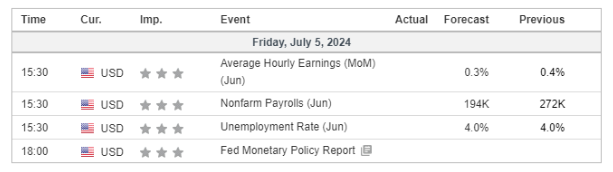

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.7%) VS -25 bps (10.3%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the US dollar against a basket of six major currencies, remained flat but extended its losses slightly due to downbeat expectations for the upcoming US economic report. Investors are closely watching the US jobs report for further trading signals. Economists are projecting an increase of only 190,000 in Non-farm Payrolls, down from the previous 274,000, with the unemployment rate expected to remain steady at 4.0%. Volatility is expected to continue as the crucial US nonfarm payrolls report approaches.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 105.15, 105.50

Support level: 104.45, 104.05

Gold prices remained flat due to US holidays and a lack of market catalysts. Previously, dovish statements from Federal Reserve members and pessimistic economic performance weighed down the dollar, supporting the gold market. Additionally, ongoing US election debates and the upcoming 2024 Presidential election could increase market volatility, further supporting the safe-haven appeal of gold.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 2360.00, 2385.00

Support level: 2320.00, 2295.00

The GBP/USD pair traded steadily at its three-week high, with minimal movement due to the U.S. public holiday yesterday. Traders adopted a “wait-and-see” attitude as the U.K. general election took place last night. The Labour Party is poised to overthrow the Conservative Party, which has been in power for the past 14 years. A far-right policy from the Labour Party is expected to stimulate Sterling’s strength.

The GBP/USD pair has broken above the uptrend channel while consolidating at an elevated level, suggesting the pair remains trading within its uptrend trajectory. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting the bullish momentum remains intact with the pair.

Resistance level: 1.2850, 1.2940

Support level: 1.2660, 1.2600

The EUR/USD pair edged higher, testing its resistance level at 1.0816. The recently disclosed ECB monetary policy meeting minutes revealed that the rate cut surprised some members. Policymakers have also clarified that there will be no changes at the upcoming July meeting, while September remains a possibility. This has provided marginal strength to the euro.

EUR/USD continues to trade within its uptrend trajectory and is about to break above its near-resistance level at 1.0816. The RSI is set to break into the overbought zone while the MACD continues to edge higher, suggesting the pair remain trading with bullish momentum.

Resistance level: 1.0853, 1.0900

Support level: 1.0767, 1.0735

The Japanese equity market is close to a new high since April and is a whisker away from reaching its all-time high above the 41,100 mark. The risk-off sentiment from Wall Street has been mirrored in the Asian markets, which became more appealing yesterday as the U.S. observed a public holiday. Recent economic indicators are not convincing enough for the Bank of Japan (BoJ) to raise interest rates further, and a dovish monetary policy is expected to provide buoyancy for the equity market.

Nikkei edged higher after a price consolidation, suggesting a bullish signal for the index. The RSI has been flowing within the overbought zone, while the MACD showed signs of a rebound, suggesting the index remains trading with strong bullish momentum.

Resistance level: 41120.00, 41400.00

Support level: 40850.00, 40630.00

The Japanese yen has regained some strength, appreciating against the dollar as markets remain vigilant, anticipating possible intervention by Japanese authorities to prevent excessive depreciation. Japan’s near-zero interest rates create a significant rate differential with other major currencies, leading to global pressure on the yen.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 161.20, 161.95

Support level: 160.50, 159.85

Oil prices are trading higher, reaching a two-month peak due to optimism over increased summer demand and speculations over supply disruptions. Previously, oil inventory data showed a decline much higher than market expectations. Additionally, the continued depreciation of the US dollar has supported dollar-denominated oil.

Oil prices are trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 62, suggesting commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 84.75, 86.35

Support level: 82.10, 80.05

Berdagang forex, indeks, Logam banyak lagi pada spread rendah industri dan pelaksanaan sepantas kilat.

Daftar untuk Akaun PU Prime Live dengan proses kami yang mudah

Membiayai akaun anda dengan pelbagai saluran dan mata wang yang diterima dengan mudah

Akses beratus-ratus instrumen di bawah keadaan perdagangan terkemuka pasaran

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!