Muat turun aplikasi

-

- Platform Dagangan

- Aplikasi PU Prime

- PU Copy Trading

- PU Sosial

-

- Syarat Perdagangan

- Jenis Akaun

- Spread, Kos & Swap

- Deposit & Pengeluaran

- Yuran & Caj

- Waktu Dagangan

Muat turun aplikasi

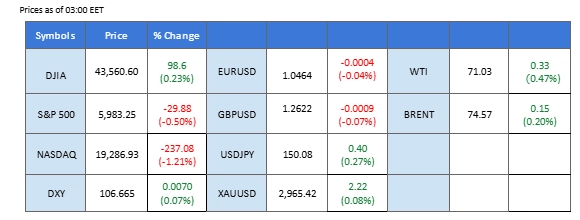

Market Summary

As broader financial markets, including forex and equities, remained subdued, safe-haven assets emerged as the preferred choice for investors. Gold prices surged to fresh all-time highs in the previous session, reflecting growing risk aversion amid geopolitical and economic uncertainties.

Meanwhile, crude oil prices found strong support above the $70 per barrel mark, buoyed by fresh U.S. sanctions on Iran and Iraq’s commitment to cutting oil supply—both of which reinforced supply-side concerns and provided a bullish catalyst for the commodity.

In the forex market, the U.S. dollar staged a technical rebound, with the Dollar Index (DXY) gaining over 0.5% from its recent lows. The rebound came after Trump reaffirmed that tariffs on Mexico and Canada remain on schedule, offering the greenback some relief. However, the Japanese yen remained firm as Japan’s long-term bond yields continued to climb, signaling growing hawkish expectations for the Bank of Japan’s (BoJ) policy outlook. Traders are now eyeing Wednesday’s BoJ Core CPI reading for further clues on the central bank’s next move.

The crypto market faced a sharp downturn, with Bitcoin (BTC) dropping below $92,000 and Ethereum (ETH) plunging nearly 10% in the last session. Risk sentiment deteriorated further after Bybit, the world’s second-largest crypto exchange, was hacked, leading to a $1.5 billion asset loss. Additionally, multiple U.S. state governments moved to block a bill advocating Bitcoin as a reserve asset, exacerbating risk-off sentiment and triggering a widespread crypto sell-off.

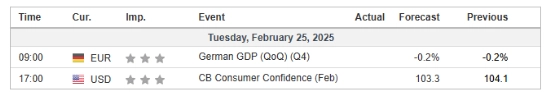

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The U.S. dollar remained flat as traders adopted a cautious stance ahead of key economic data. The PCE Price Index, a critical inflation metric closely watched by the Fed, could provide additional clarity on monetary policy direction. Until then, the dollar is expected to trade in a narrow range as investors await fresh signals on inflation and interest rate expectations.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 107.55, 108.40

Support level: 106.55, 105.65

Gold prices remained supported by safe-haven demand as risk sentiment deteriorated. Concerns over trade tariffs under former President Donald Trump have prompted cautious trading, with Trump confirming that 25% tariffs on Mexico and Canada will take effect next week as planned. On the other hand, investors are also eyeing the upcoming Personal Consumption Expenditures (PCE) Price Index for January, a key inflation gauge for the Federal Reserve, which could drive further movement in gold.

Gold prices are trading higher while currently testing the resistance level. However, MACD hs illustrated diminishing bullish momentum, while RSI is at 55, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2955.00, 2970.00

Support level: 2935.00, 2920.00

The GBP/USD pair maintained its overall bullish structure, despite experiencing a minor sell-off in the last session as the U.S. dollar rebounded. The greenback found support after staging a technical recovery, but the Pound Sterling remained resilient, underpinned by last week’s strong CPI and Retail Sales data, which reinforced expectations of a hawkish Bank of England (BoE) stance. Looking ahead, traders are closely monitoring remarks from BoE officials today, which could provide fresh insights into the central bank’s monetary policy outlook.

GBP/USD remain trading within its uptrend trajectory suggesting a bullish bias for the pair. However the bullish momentum is seemingly easing with the RSI declining while the MADC is edging lower toward the zero line from the above.

Resistance level: 1.2665, 1.2780

Support level: 1.2575, 1.2502

The EUR/USD pair has formed an “Evening Star” candlestick pattern, a potential bearish reversal signal, in the last session. However, the pair is currently hovering flat, awaiting a catalyst to determine its next direction. Fundamentally, the Eurozone CPI met market expectations, while the German election results aligned with forecasts, mitigating political risk in the region. These factors have lent support to the euro, keeping it relatively stable despite broader market uncertainty. Moving forward, traders will focus on the U.S. dollar’s movement—should the greenback ease today, EUR/USD could seize the opportunity to push higher

EUR/USD remains trading above its uptrend support level, suggesting a bullish bias for the pair. If the pair is able to find support at above the 1.0450 mark after a technical retracement, it will be a bullish signal for the pair. The RSI has eased while the MACD is flowing flat, suggesting that the bullish momentum is easing.

Resistance level: 1.0515, 1.0596

Support level: 1.0445, 1.0385

Nasdaq extended its decline as the AI sector faced renewed pressure. Nvidia dropped another 3% ahead of its earnings report, with investors questioning whether the AI-driven rally can maintain its momentum, particularly after the launch of China’s DeepSeek AI. Broader tech stocks also struggled as skepticism grew over the sustainability of future AI infrastructure investments, weighing on overall sentiment.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 21615.00, 22240.00

Support level: 21110.00, 20605.00

The USD/JPY pair saw its bearish momentum stall in the last session as traders reacted to comments from former U.S. President Donald Trump. Trump reaffirmed that the planned tariffs on Canada and Mexico remain on track, which boosted the U.S. dollar, leading to a technical rebound for USD/JPY. Meanwhile, Japanese Yen traders are closely watching the upcoming BoJ Core CPI reading, scheduled for release tomorrow. This data will be crucial in gauging inflation trends in Japan, which could influence the Bank of Japan’s next monetary policy move.

The USD/JPY pair is rebounding. A break above the previous high at 150.45 shall be seen as a bullish trend reversal signal for the pair. The RSI has broken above the oversold zone, while the MACD has a golden cross at the bottom, suggesting that the bearish momentum may be easing.

Resistance level: 151.30, 152.75

Support level: 149.50, 147.50

Oil prices have rebounded above the key psychological support at $70.00, gaining over 1% in today’s session. The market is reacting to fresh U.S. sanctions on Iranian oil, which could trigger short-term supply disruptions and tighten global supply conditions. Adding to the bullish momentum, Iraq has reaffirmed its commitment to cutting output in alignment with OPEC’s production policies, further fueling oil’s upside move. Should the oil prices be able to break above the Fibonacci retracement level of 61.8% at $71.78 mark, it will be a solid bullish trend reversal for the oil prices.

Crude oil found support at the above $70.00 mark and rebounded, suggesting a potential trend reversal. The RSI has also rebounded above the oversold zone, while the MACD continues to edge lower, suggesting the bearish momentum remains overwhelming.

Resistance level: 72.73, 75.00

Support level: 70.25, 67.80

Berdagang forex, indeks, Logam banyak lagi pada spread rendah industri dan pelaksanaan sepantas kilat.

Daftar untuk Akaun PU Prime Live dengan proses kami yang mudah

Membiayai akaun anda dengan pelbagai saluran dan mata wang yang diterima dengan mudah

Akses beratus-ratus instrumen di bawah keadaan perdagangan terkemuka pasaran

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!