Muat turun aplikasi

-

- Platform Dagangan

- Aplikasi PU Prime

- PU Copy Trading

- PU Sosial

-

- Syarat Perdagangan

- Jenis Akaun

- Spread, Kos & Swap

- Deposit & Pengeluaran

- Yuran & Caj

- Waktu Dagangan

Muat turun aplikasi

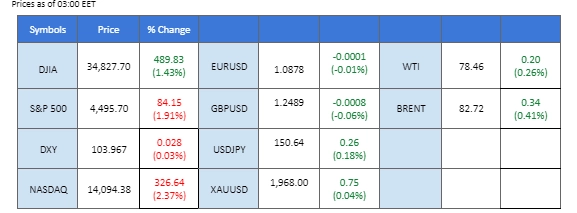

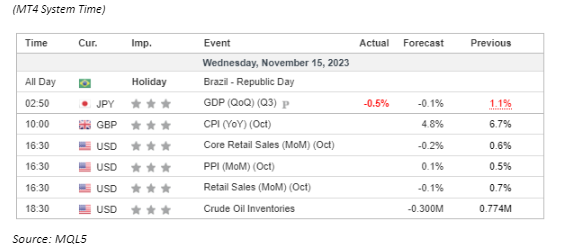

The Dollar index took a substantial hit, plummeting over 1.5% in the wake of the U.S. Consumer Price Index (CPI) release. The data indicated a softening of inflationary pressures, leading the market to reassess the likelihood of further interest rate hikes in the U.S., suggesting that the peak in interest rates may have been reached. In a counterintuitive move, equity markets responded positively to the subdued CPI figures, closing higher. All eyes are now focused on the upcoming meeting between Chinese and U.S. leaders in San Francisco, with expectations of potential market implications. Meanwhile, oil prices find themselves in a state of uncertainty, as the International Energy Agency revises down the demand outlook for this quarter. The dampened demand forecast comes amidst surprising production growth from the U.S. and Brazil, surpassing earlier projections.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The US Dollar faced a significant downturn following a disappointing inflation report, fueling speculation that the Federal Reserve could halt its tightening monetary policy. The US Consumer Price Index (CPI) for the last month registered a decline from 0.4% to 0.0%, falling below market expectations of 0.1%. This prompted a more than 1% drop in the dollar index against major currencies, as US Treasury yields plunge on easing rate hike expectations.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 18, suggesting the index might enter oversold territory.

Resistance level: 104.80, 105.40

Support level: 104.05, 103.30

The sharp depreciation of the US Dollar led to a surge in demand for dollar-denominated gold, resulting in an extension of gold prices’ upward trajectory. Investors are closely watching the upcoming US-China meeting for potential impacts on market dynamics, as any positive developments in the relationship might redirect funds to riskier assets, impacting gold’s appeal.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 1965.00, 1985.00

Support level: 1940.00, 1915.00

The EUR/USD pair experienced a notable surge, breaking above its uptrend channel, indicating robust bullish momentum in the market. The disappointing U.S. Consumer Price Index (CPI) reading released yesterday was the catalyst for this upward movement. The data revealed a continued easing of inflationary pressures in the U.S., leading to speculation that interest rates may have already peaked, consequently putting downward pressure on the dollar’s strength.

EUR/USD price movement exhibited a strong bullish trend as it has broken above its uptrend channel. The MACD continues to diverge above the zero line while the RSI has broken into the overbought zone, suggesting the bullish momentum is strong.

Resistance level: 1.0954, 1.1040

Support level: 1.0775, 1.0700

The Cable exhibited robust trading, surging by almost 1.8% following the release of the U.S. Consumer Price Index (CPI). The notable gain can be attributed to the weakening strength of the dollar, driven by the U.S. CPI data indicating controlled inflation and the Federal Reserve’s success in orchestrating a soft landing through its monetary tightening policy. The focus for Cable traders now shifts to the upcoming release of the U.K. Consumer Price Index (CPI) later today, expected to introduce potential fluctuations in Cable’s price movement.

GBP/USD is trading with a higher high price pattern, suggesting a bullish trend. The RSI has broken into the overbought zone while the MACD continues to diverge above the zero line, suggesting the bullish momentum is strong.

Resistance level: 1.2660, 1.2790

Support level: 1.2420, 1.2310

Wall Street experienced a robust rally as the new US inflation data raised hopes of an end to Federal Reserve rate hike policies. Lower-than-expected inflation figures fueled expectations that the Fed might reconsider its rate hike stance, leading to a dip in US Treasury yields and heightened appeal for the stock market. The Dow Jones Industrial Average surged 1.43%, the S&P 500 briefly crossed the key 4,500 level, and the Nasdaq Composite jumped 2.37% for its best day since April.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 76, suggesting the index might enter overbought territory.

Resistance level: 34935.00, 35465.00

Support level: 34370.00, 33780.00

The AUD/USD pair staged a robust rebound, positioning itself firmly within a crucial liquidity zone while encountering resistance at the 0.6510 level. The pronounced surge can be attributed to the softening of the U.S. dollar’s strength, a reaction to the underwhelming U.S. Consumer Price Index (CPI) that led the market to speculate on a potential peak in U.S. interest rates. Concurrently, the Australian dollar found support in optimistic expectations regarding the potential easing of China’s restrictions on Australian beef and lobster, with officials expressing confidence in positive implications for the Aussie dollar.

The pair has rebounded but the next resistance level is crucial for the pair to test its strength. The RSI has broken into the overbought zone while the MACD has broken above the zero line and diverged, suggesting a strong bullish trend.

Resistance level: 0.6510, 0.6620

Support level: 0.6390, 0.6300

The USD/JPY pair experienced a significant decline of almost 1% from its pivotal resistance level at 151.69, marking its recent peak. This downturn primarily resulted from the waning strength of the U.S. dollar, prompted by a lower-than-anticipated U.S. Consumer Price Index (CPI) reading. Attention in the market has now shifted towards the imminent release of U.S. Producer Price Index (PPI) and U.S. retail sales data, anticipated to introduce volatility to the pair’s price dynamics.

USD/JPY plunged yesterday from its strong resistance level at 151.69 but has found support at the 150.40 range. The RSI dropped sharply to the lower region while the MACD was on the brink of breaking below the zero line, suggesting the bullish momentum had vanished.

Resistance level: 151.70, 152.70

Support level: 150.40, 149.30

Oil prices maintained stability amid mixed fundamentals, with the International Energy Agency (IEA) revising its demand growth forecasts upward. The US Dollar’s fall, influenced by the lacklustre inflation report, provided some support. However, uncertainties loom as investors await the US Energy Information Administration’s (EIA) oil inventory report delayed by a recent system upgrade.

Oil prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 51, suggesting the commodity might trade lower as technical correction, since the RSI retreated sharply from overbought territory.

Resistance level: 78.80, 80.75

Support level: 75.35, 73.35

Berdagang forex, indeks, Logam banyak lagi pada spread rendah industri dan pelaksanaan sepantas kilat.

Daftar untuk Akaun PU Prime Live dengan proses kami yang mudah

Membiayai akaun anda dengan pelbagai saluran dan mata wang yang diterima dengan mudah

Akses beratus-ratus instrumen di bawah keadaan perdagangan terkemuka pasaran

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!